Sustained growth trend with a drop in demand? Forecasts and challenges in the German CEP market

The recently published CEP Study 2023 by the Bundesverband Paket & Expresslogistik (BIEK) (Federal Association of Parcel & Express Logistics) once again presents a panorama of the CEP industry in Germany that is saturated with figures. We explain why shipping volumes are the smaller challenge for the German CEP market despite a strong decline in 2021/22.

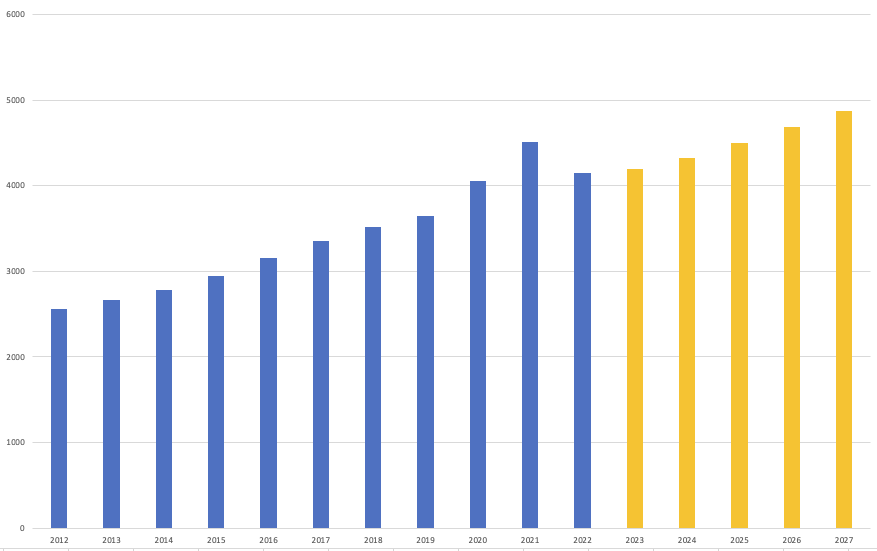

The BIEK sees itself as representing the interests of the German CEP sector and also pursues economic policy motives with its publications and studies. Nevertheless, the annual CEP study offers interesting and relevant insights into the current challenges facing the industry. And for the German CEP industry, 2022 was an unusual year: for the first time since 2012, shipping volumes declined; and significantly so, by a total of 7.9 %. At the same time, turnover also fell by around 3.5 % compared to 2021.[1] The declines are unevenly distributed; in the B2B segment, the volume also fell significantly by 4 %, but more weakly than in the market as a whole.

There are two main reasons for the clearly negative development. Firstly, the general economic climate: economic uncertainty as a result of the Ukraine war, disrupted supply chains, shortage of raw materials, etc. The second reason was the economic crisis. While companies merely reduced their production and postponed investments, the price and interest rate increases were felt much more strongly by private households and led to much more restrained consumption. Online trade in particular, which has been the growth driver in the B2C business for years, declined sharply.

Development of the CEP market remains positive – especially in the B2B segment

However, an end to the growth trend cannot be deduced from the figures. Because if you zoom out, widen your view and don’t just look at the last two years, it becomes apparent that 2022 probably only represents a dip. The medium- and long-term trend, on the other hand, actually seems to be unbroken.

Although the volume in 2022 is below the volume in 2021, it is still a little larger at 4.15 billion items than in 2020 with only 4.05 billion items. The B2B segment in particular developed comparatively positively over the year. The decline there weakened over the course of the year and the market was able to gradually recover by the end of the year after an initial crisis shock. Looking at the market shares, it becomes even clearer that the B2B segment is more crisis-proof and has gained 1-2% compared to the B2C segment.

Growth settles down to normal after exceptional year

It is not without reason that the study authors point out at various points that 2021 was the actual exceptional year and not 2022, where a clear pandemic-related increase was observed, especially in the B2C segment. In this respect, the negative development last year may only represent a return to the “normal” growth path.

Whether this is the case remains to be seen. However, the study’s authors are cautiously optimistic about the future and assume – supposing a favourable economic development – about 1 % growth in the B2B segment. By 2027, the total market is expected to grow to almost 4.9 million shipments, which would correspond to an increase of about 20 % compared to 2022.

The major tasks of the German CEP sector are the old ones

The real challenges of the CEP market in Germany are not a lack of shipment volumes, even though they are related to this. Demand will probably continue to rise, albeit less strongly than before. Rather, the difficulties are increasing in areas that the industry has actually been dealing with for years.

Revenues per shipment

Across the industry, average revenue per consignment increased nominally to €6.26. This is an increase in value of just under €0.30 compared to 2021. What looks good at first, however, becomes a problem on closer inspection. Because adjusted for inflation, the average revenues are falling and are even about 5 % below the level of 2012.

One reason for this is the continuing shifts between market shares in the German CEP market. In the B2B and B2C segments, for example, the volume of high-margin express and courier shipments is growing more slowly than standard shipments, so that their share of the overall market has actually declined. Shippers will probably face additional price adjustments in the coming weeks and months.

Personnel

The logistics industry is also feeling the effects of the shortage of skilled workers. Even with a moderate growth forecast, the study’s authors predict an additional demand of 20,000 employees by 2027. The productivity increases that have already occurred and are still expected due to increasing automation and digitalisation, especially in logistics centres, have already been taken into account. This will have an impact on transit times, cost and price development and the service quality of CEP service providers – especially in the delivery and collection of consignments.

Increasing requirements and high need for investment

CEP services have been confronted with increasing customer demands for years: overnight delivery, social responsibility, transparency and sustainability are becoming increasingly important selection criteria on the part of customers – not only in the B2C segment. In addition, there are related stricter regulatory requirements. According to Christoph Trepp, Professor of Distribution and Trade Logistics at the Nuremberg University of Applied Sciences, “there are several swords of Damocles hanging over the industry. (…) These include further minimum wage and toll increases, stricter dealings with subcontractors, and numerous measures to increase eco-transparency and reduce the CO₂ footprint.”[3]

Making your own dispatch crisis-proof

Overall, the CEP Study 2023 of the BIEK shows that despite an exceptionally long sustained growth phase, the dispatch service providers have not managed to get a grip on central problems. These include first and foremost the revenue per shipment, which continues to not cover costs. Ironically, the CEP services themselves are partly to blame for this, as the increased quality of their national and international standard services has led to declines in the higher-margin express and courier shipments. Since in the boom years there was always a CEP service that could offer online retailers even lower prices, consumers in the B2C sector are now hardly willing to tolerate necessary price increases. Higher margins are most likely to be achieved in the B2B segment.

What can those responsible for shipping in companies do now? Flexibility is the key word. Because economically it makes no sense to be dependent on one provider, today less than ever. By working with several CEP services, you can not only choose between different services and prices. You also have full control over your costs at all times and are not dependent on strikes and price increases at individual providers. However, juggling multiple balls ties up valuable resources in terms of time and attention. Multi-carrier shipping platforms take this work off your hands so you can focus on what’s important!

[1]Perspektive eröffnen, Gemeinschaft gestalten. KEP-Studie 2023 – Analyse des Marktes in Deutschland. Eine Untersuchung im Auftrag des Bundesverbandes Paket und Expresslogistik e. V. (BIEK), Erhältlich über https://www.biek.de/publikationen/studien.html

[2] Graphic based on data provided by the CEP-Study 2023 of BIEK.

[3]https://www.dvz.de/rubriken/land/kep/detail/news/kep-dienste-der-handlungsdruck-waechst.html

DO YOU HAVE ANY QUESTIONS?

Just give us a call – we’ll be happy to advise you personally: +49 40 734 4566 22 or by email: vertrieb@letmeship.com

Together we will find the right solution for your shipping needs!