FAQ „Temporary admission“: What you should know and consider when temporarily importing into Germany

If you import goods from a third country that are further processed, handled or repaired within Germany (EU) and then re-exported to a third country, import duties and taxes may not apply. However, certain conditions must be fulfilled and a corresponding authorisation from the customs authorities must be provided. The following FAQs support those responsible for shipping in companies in carrying out their shipping processes smoothly when temporarily importing goods.

What does “temporary import” mean?

With temporary importation, goods are imported into a country for a short period of time, i.e. temporarily. In the case of a “temporary export”, goods leave the customs territory of the EU, but it is certain that these goods will be re-imported within a certain period of time. As a rule, these are goods such as exhibition items, samples of goods or equipment for repairs or finishing (e.g. galvanisation) of machine or spare parts or even returns.

What are the categories of temporary import?

Temporary imports are divided into two categories, depending on the reason for the shipping. Here you should first check whether you are returning the products/goods you are importing unmodified (= temporary import unmodified) or whether you are modifying them in any way (= temporary import modified).

When can I use the temporary importation customs procedure (“unmodified”)?

If you want to re-import your goods (such as promotional materials, sports equipment for competitions, etc.) unmodified, we recommend the standard temporary importation or temporary admission procedure.

The temporary admission procedure allows total or partial relief from import duties for non-Union goods.

This applies only to goods which

- are intended for temporary use for a specific purpose in the customs territory of the EU

- are not to be altered during use within the EU

- are intended from the outset to be re-exported from the customs territory of the EU

If you want to make use of temporary admission, you must apply for the corresponding authorisation from German customs. Check which permits are required and whether you need the support of a customs broker for customs clearance.

When you can use customs procedures such as Carnet ATA or the transit procedure under customs supervision (TIB) is explained below.

If your goods are repaired, modified or processed, you must use the inward processing procedure.

When can I use the temporary importation customs procedure (“modified”)?

If you want to send goods that need to be processed, repaired or adapted, they may meet the requirements for temporary admission. These include, in particular, components for assembly and repair and metal products.

4 Conditions for temporary imports (modified/processed):

- The goods are imported to be repaired, modified or processed.

- The goods must leave the country within a certain period of time.

- The goods may not be sold, rented or given away without notifying the customs authorities.

- The imported goods must still be recognisable in the final products that are imported.

What does “outward processing” mean?

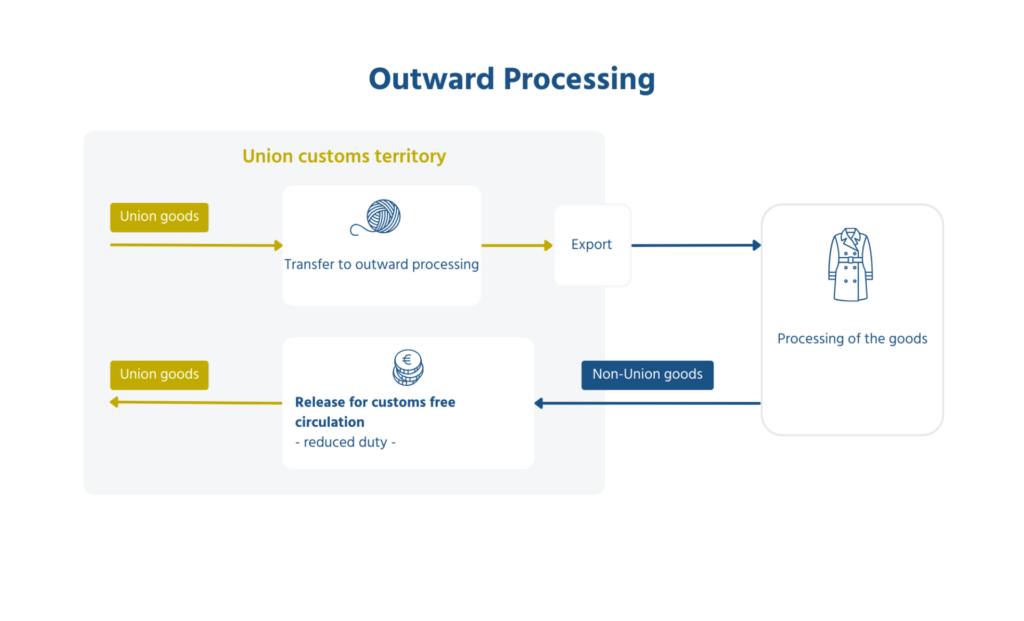

The outward processing procedure means that a country’s goods (Union goods) may be temporarily exported from the customs territory of the Union in order to carry out processing operations. Processing operations include the working, processing, destruction or repair of goods.

Often the outward processing procedure has an economic background. It is a matter of outsourcing working or processing operations to a less expensive foreign country. In contrast to inward processing, the Union goods are exported from the customs territory of the EU and re-imported in processed form. Outward processing takes place in three phases: Union goods are temporarily exported from the customs territory of the Union, undergo processing operations in the third country and, after re-importation, are released for free circulation with total or partial relief from import duties.1

In order to be able to make use of outward processing, you need an authorisation from German customs. A simplified authorisation procedure is possible for simple repairs. In this case, the customs declaration also serves as an application for authorisation.

What does “inward processing” mean and how do I declare it?

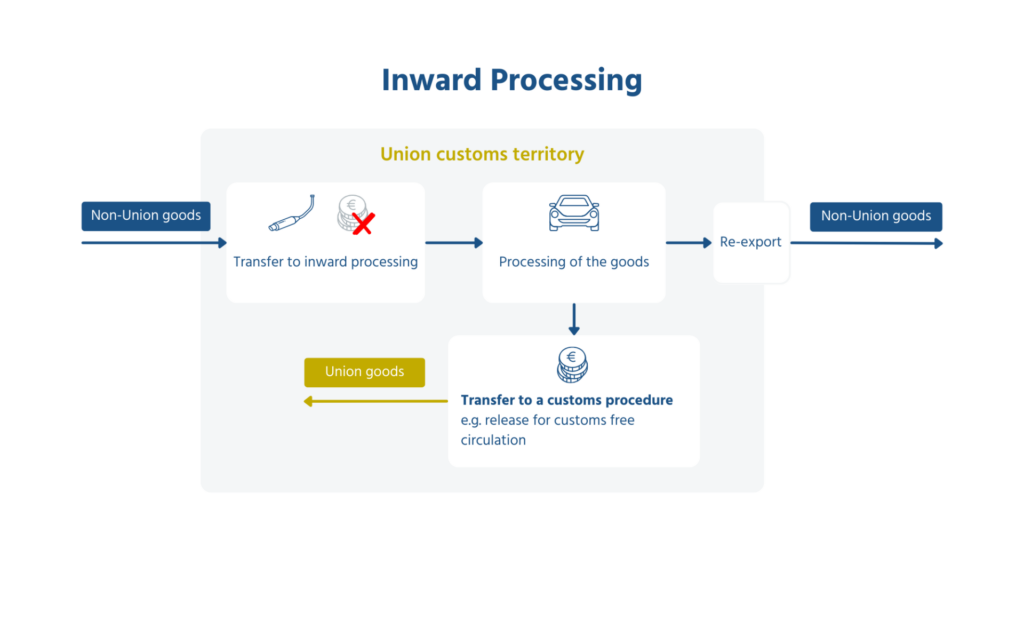

The inward processing procedure allows you to temporarily import goods into the customs territory of the Union free of import duties.

The purpose of inward processing is to allow companies to process non-Union goods before deciding whether the processed or finished goods should enter the Union market or whether the goods should be re-exported.

The use of the inward processing customs procedure, like the outward processing procedure, requires an authorisation. This can be granted either in a formal authorisation procedure by the respective customs office or in a simplified manner on the basis of an electronic customs declaration (simplified authorisation procedure).2

How can I apply for temporary importation (modified)?

- Check which permits are required and whether you need the assistance of a customs broker.

- Check which temporary processing relief you need.

- If you want to use the inward or outward processing procedure, you must comply with the customs requirements of the country to which you want to send the goods or from which you want to send the goods.

- In the case of outward processing, the export declaration must be completed correctly. You should also mention that the goods are intended for outward processing.

What is the difference between temporary import and re-import?

Re-import is the re-importation of goods sold and exported in the country of origin. Reimports take place almost exclusively in the case of motor vehicles and pharmaceuticals. Although no customs duties are payable within the EU, the goods must pass through customs. Under certain conditions, re-imports from a non-EU country can even remain duty-free. The prerequisite for re-importation is that the goods are the same (unchanged) as when they were exported. Proof (e.g. serial or manufacturing number, description of goods or seal) must then be provided that the goods are really the ones shipped from the office of departure.

What is the Carnet ATA and when do I need to use it?

The Carnet ATA (Admission Temporaire) is also commonly referred to as a passport for goods and is recognised in 78 countries worldwide. The international customs document facilitates the clearance of imports, exports and transit of goods and can be used instead of the required national customs documents of the respective country. It also replaces the security to be provided directly at the borders (cash payment, bank guarantee or surety bond) for the duties and taxes charged on the goods. We recommend the Carnet ATA for shipments to third countries where customs surveillance makes sense. It is suitable for temporary export from Germany to the world (via air or sea freight). Please note that the Carnet ATA may not be used for goods intended for processing or repair.

The Carnet ATA is issued in Germany exclusively by Chambers of Industry and Commerce. The competent Chamber of Industry and Commerce also accepts applications for the issuance of an Carnet ATA and for the conclusion of a bond insurance policy. It should be noted that under the CARNET ATA procedure, advance payment of customs duties, taxes and fees may be required.

What does transit procedure under customs supervision (TIB) mean?

In the case of temporary imports under customs supervision, a deposit must usually be made with the customs authorities of the country to which you are sending the goods. This is to ensure that you export the goods again. When your goods leave the country, the deposit is returned. If the goods are not re-exported within the specified period, the deposit will be retained. The bond (also called security deposit) is usually double the amount of duties and taxes. In the USA, the payment of the security deposit is absolutely common when importing dutyless goods for exhibition purposes. The transit procedure of temporary imports under customs supervision is suitable for the transit of your goods.

Our tip for the export declaration

Usually, export declarations for the shipment of your goods are completely handled by the assigned CEP service provider. However, temporary import is not a standard procedure. Therefore, we recommend that you apply for the export declaration for a temporary import yourself electronically at customs. The actual shipping process, once all the documents required by the customs authorities are available, is then taken over by the CEP service providers, such as DHL, TNT, FedEx or UPS.

Sources:

1 https://www.zoll.de/DE/Unternehmen/Warenverkehr/Einfuhr-aus-einem-Nicht-EU-Staat/Verfahren/Passive-Veredelung/passive-veredelung_node.html#:~:text=Die%20passive%20Veredelung%20l%C3%A4uft%20in,den%20zollrechtlich%20freien%20Verkehr%20%C3%BCberlassen.

2 https://taxation-customs.ec.europa.eu/customs-4/customs-procedures-import-and-export-0/what-exportation/outward-processing_de#:~:text=Passive%20Veredelung%20bedeutet%2C%20dass%20Unionswaren,der%20Union%20ausgef%C3%BChrt%20werden%20k%C3%B6nnen.