The Spanish parcels market has proven to be crisis-proof

Despite the crisis accentuated by the 2020 pandemic, the Spanish parcels market has proven to be quite resilient in recent years. The annual report on the postal sector produced by the Spanish National Commission for Markets and Competition (CNMC) shows a steady increase in parcel volumes and revenues in recent years. However, some challenges remain.

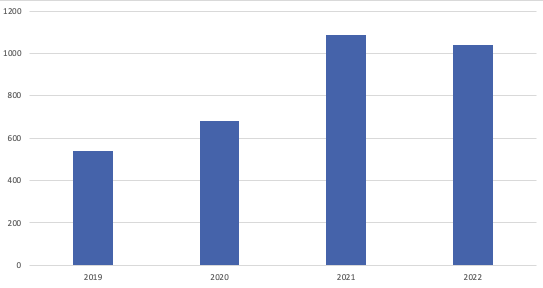

The annual report on the postal sector of the Comisión Nacional de los Mercados y la Competencia (CNMC) contains statistical information on the postal segment SPT and the parcels segment CEP. The underlying data are regularly collected from postal and parcel service providers. For 2022, 22 CEP parcel service providers with 50 or more employees were surveyed, and unusual figures were obtained: With a significant decline of 4.4% compared to 2021, the market is experiencing its first negative growth since 2017 and only the second in the last ten years. However, the submarket is developing more stably than the postal sector, which overall moves 10% less volume than in the previous year. In contrast, CEP’s pure revenues increased by 1.9%.1

The decline is mainly due to B2C business. The rising cost of living and economic uncertainty have reduced consumer spending. This is especially felt in online retailing (e-commerce), which, on the other hand, has become the growth driver of the B2C business and the CEP market in Spain.

Development in the CEP market remains stable and positive

However, if we broaden our vision a little and take a look at the overall evolution of the last few years, a different picture emerges. Indeed, after a very dynamic development in 2020 and 2021, with strong growth, the market seems to be returning to a more sustainable development, but overall a growth path can be observed.

Although the volume in 2022 is lower than in 2021, it is still 93% higher than in 2019, and turnover is still 59% higher. And even if we take 2020 as a reference year, the volume of shipments is still 65% higher, with 1,039 million parcels.2

The Spanish CEP market is a fragmented market, with many small, partly regional suppliers. However, it is dominated by three large providers who, after the low of 44.1% market share in 2020, now carry 52.5% of the total volume again. Therefore, there is no fundamental change here either, despite some significant shifts in market share among the companies.

Challenges facing the Spanish CEP market

One of the strengths of the CNMC reports is the holistic view of the different areas of the freight sector, supported by figures. This makes it clear that parcel volumes and turnover are not the biggest challenge for the Spanish parcel market. According to forecasts, demand will continue to grow. However, the evolution that the sector has been facing for a few years will continue in 2023.

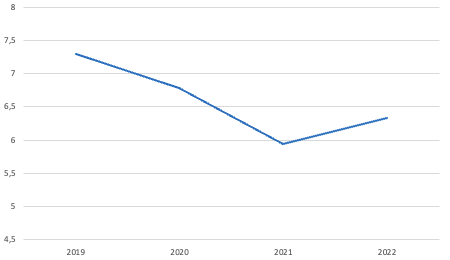

Revenue per shipment

After a significant decline of around 18.6% between 2019 and 2021, the average revenue per shipment in the CEP segment increased again for the first time since 2019, by 6.6% year-on-year. However, at €6.33, the sector is still a long way from the peak of €7.29 reached in 2019. What at first seems positive, however, is actually a problem. This is because Spain also experienced high inflation of 8.32% in 2022 due to the crisis, so turnover per shipment actually fell when adjusted for inflation.

The increase in average turnover is likely to be due, on the one hand, to repeated price increases since 2019 and, on the other hand, to changes within the market. For example, the share of domestic versus international shipments has decreased from 72.3% in 2021 to 67.8% in 2022, and there are also slight shifts in parcel sizes towards heavier – and therefore more expensive – parcels (parcels over 2 kg: 30% share versus 26.2% in 2021). From the customer’s point of view, it is satisfactory that no further price increases have been announced so far. However, they are likely to be unavoidable in view of the negative profit situation.3

Personnel

The number of employees in the CEP market has increased by 2 to 4 % annually in recent years.4 The shortage of skilled workers has long since reached the logistics sector, especially among truck drivers. It is no longer possible to fill all positions, and the real crisis is yet to come: in the next few years, approximately one third of all drivers will retire. For CEP service providers, this means increased competition for labour, with the expected effects on transit times, cost and price developments and service quality, especially in the delivery and collection of consignments.

Your B2B shipments crisis-proof

Overall, current figures show that the Spanish CEP market is developing more stably than the market as a whole, which is of particular benefit to pure CEP service providers. However, the shortage of drivers, which will worsen in the sector in the coming years, and the insufficient volume of business are weighing on the outlook, despite the positive volume development expected in the coming years.

What can logistics managers in companies do now? Flexibility is the key word. From an economic point of view, it does not make sense to be dependent on a single supplier, even less so today than in the past. By working with several CEP services, you can not only choose between different services and prices. You also have full control over costs at all times and are not dependent on strikes and price increases from different suppliers. However, managing multiple suppliers takes up a lot of time and attention. Multi-carrier shipping platforms reduce this work considerably so that you can focus on what is important.

1 INFORME ANUAL DEL SECTOR POSTAL (2022), Comisión Nacional de los Mercados y la Competencia (CNMC), cnmc.es

2 INFORME ANUAL DEL SECTOR POSTAL (2021), Comisión Nacional de los Mercados y la Competencia (CNMC), cnmc.es / INFORME ANUAL DEL SECTOR POSTAL (2020), Comisión Nacional de los Mercados y la Competencia (CNMC), cnmc.es

3 INFORME ANUAL DEL SECTOR POSTAL (2022), Comisión Nacional de los Mercados y la Competencia (CNMC), cnmc.es

4 INFORME ANUAL DEL SECTOR POSTAL (2022), Comisión Nacional de los Mercados y la Competencia (CNMC), cnmc.es / INFORME ANUAL DEL SECTOR POSTAL (2021), Comisión Nacional de los Mercados y la Competencia (CNMC), cnmc.es / INFORME ANUAL DEL SECTOR POSTAL (2020), Comisión Nacional de los Mercados y la Competencia (CNMC), cnmc.es