World trade goods barometer and European CEP market show slightly positive trends

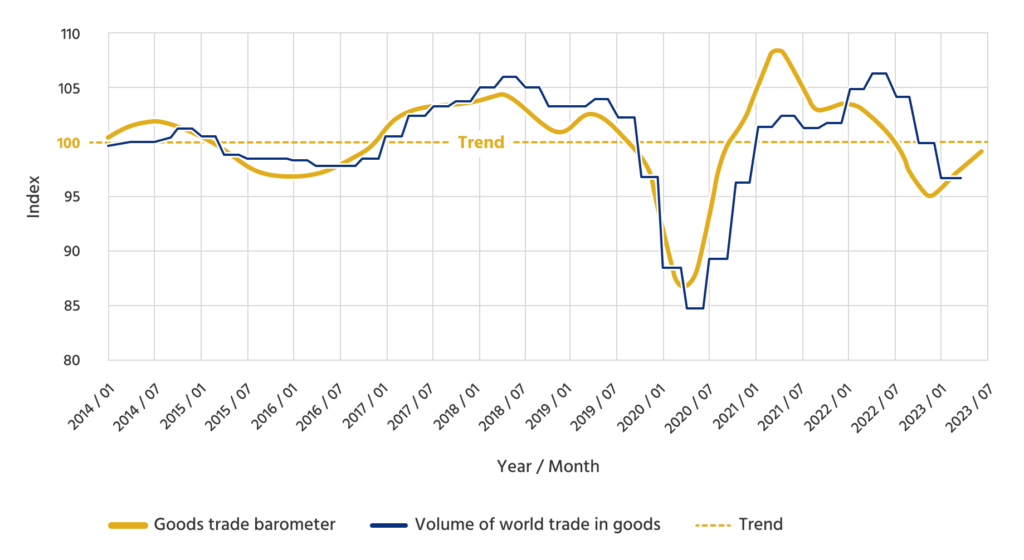

The WTO’s Trade in Goods Barometer, a leading indicator for global trade, shows a slight upturn in trade in 2023 following stagnation in 2022 and at the beginning of this year. Although the volume of trade in goods fell by 1.0% in the first quarter of 2023 compared to the previous year and by 0.3% compared to the previous quarter, continuing the downturn that began in the fourth quarter of 2022, the component index shows a slight upturn, driven in particular by strong automotive production and rising exports1

Nevertheless, the hoped-for global recovery failed to materialise in 2022. This was partly due to economic factors such as high food and energy prices in connection with the war in Ukraine and tighter monetary policy to combat inflation. Global import demand remains weak, weighed down by sluggish economic growth in leading economies such as the European Union and China.

Component index positive, but slightly below trend

With regard to the WTO component index, the measured values are slightly below the trend, but at 99.1 they are above the last measured value of 95.6 from May of the previous year. As the index approaches the base value of 100, there are signs of a positive trend in global trade in goods after two quarters of decline. The index for export orders (97.6), container shipping (99.5), air freight (97.5) and raw materials (99.2) rose. Exceptions were the index for motor vehicle products (110.8), which climbed well above the trend, and the index for electronic components (91.5), which fell below the trend.

Even if a sustained recovery is not certain, the figures are slightly optimistic and give rise to hope that demand on the European CEP market will also pick up again as trade increases. Below is a look at the development of the global, European and German CEP market.

Development of the global CEP market – status and outlook

China, the US and Japan alone accounted for 87% of global parcel volumes in 2022. China only grew by 2% due to the lockdown of major cities, while parcel volumes in the US fell by 2%, reflecting a post-pandemic slowdown from 33% growth in 2020.

The global parcel market achieved strong growth of 17% in 2019, then accelerated by 27% in 2020 and grew by 21% to 159 billion parcels in 2021, according to the results of the index to date. In the last seven years, the global parcel volume has increased by 150% from 64 billion parcels in 2016 to 161 billion in 2022. The pandemic accelerated the growth in parcel volumes in 2021, particularly in the online market.2

Global parcel volume development 2020 – 2022

| Year | Number of parcels | Parcels per sec. | Parcels per day |

|---|---|---|---|

| 2022 | 161 bn | 5102 | 441 m |

| 2021 | 159 bn | 5000 | 436 m |

| 2020 | 131 bn | 4160 | 360 m |

In the last 6 years, global parcel volumes have always grown at double-digit rates, but Pitney Bowes is only forecasting single-digit growth of 6% CAGR (compound annual growth rate) until 2028 due to the economic situation.3

Outlook for global parcel volumes until 2028

European CEP market trends 2021/20224

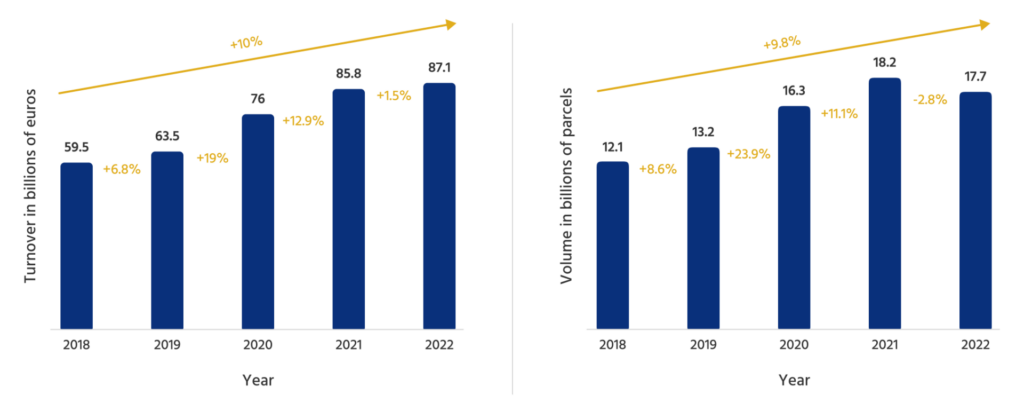

The European courier, express and parcel (CEP) market grew strongly in 2021 as the Covid-19 pandemic further boosted B2C demand but has slowed down significantly in 2022 due to numerous challenges.

Although growth in the European CEP market slowed in 2021 after extremely high growth in 2020, it remained in double digits in terms of both revenue and volume.

In 2021, the European parcel market grew by +13.3% in terms of revenue and +11.6% in terms of volume, with several countries recording growth of almost and even more than 20%! Overall, the total CEP market in Europe has reached a size of 88.1 billion euros with 18,384 million parcels.

Interestingly, revenue has grown faster than volume in 2021, so the average RPP (revenue per parcel) has increased by ~1.5%. This is mainly due to price increases made by carriers who have limited capacity and therefore favour customers who are willing to pay higher prices.

In Europe, Italy was the main good news of 2022 with a 4% increase in volume to 1.5 billion parcels, while France stagnated at 1.7 billion parcels. In contrast, there were sharp declines in the UK with a 5% drop from 5.4 billion parcels in 2021 to 5.1 billion last year and in Germany with 4.2 billion parcels last year compared to 4.5 billion in 2021.

The B2B segment recovered in 2021 and grew by 4.9% in terms of volume (14.8% B2C). Although some restrictions were still imposed during the year, they were generally less strict and less restrictive for industries and companies. Overall, several CEP service providers and cross-border carriers are less regressive than, for example, local postal operators thanks to their B2B activities.

European CEP market – outlook

Effigy Consulting5 gexpects a volume decline of around -6.1% for Europe in the first half of 2022 and a decline of -3.5% for 2022 as a whole, mainly due to a decline in the B2C segment, while the B2B segment is slowly regaining ground after the COVID years, but still showing slight negative growth. However, the revenue trend is positive and has grown faster, as freight forwarders have focussed on “high-value” shipments and increased their average prices.6

The first analysis of the first half of 2022 shows a significant decline compared to the same period in 2021 (H1/2021).7 However, it is important to consider the broader context. At the beginning of 2021, several European countries were still struggling with Covid-related lockdowns, which led to significant growth in e-commerce.

The decline in H2/2022 compared to H2/2021 has weakened compared to the decline in H1/2022 compared to H1/2021. The overall results for 2022 are therefore less weak than initially expected. The year 2022 marks a pause in terms of double-digit growth, which is due to a post-pandemic reorientation combined with geopolitical and economic challenges.

Overall, the preliminary estimate for the full year 2022 in Europe assumes a slight increase of around +1.5% in sales and a decline of around -2.8% in volume.

European parcel market: development of revenue (chart 1) and parcel volumes (chart 2) 2018 – 2022

The development of revenue was better than that of volume, which is mainly due to general price increases implemented by most airlines in most countries, with only a few exceptions. High inflation, the impact of the war in Ukraine and the rise in energy and fuel costs forced airlines to increase prices, in some cases several times during the year. In August 2023, the air freight industry recorded its first annual growth since February 2022. Global cargo kilometres (CTKs) increased by 1.5% year-on-year but are still 1.3% below the 2019 level.8

German CEP market – development and outlook

In Germany, the parcel volume fell by -7% in 2022 and reached 4.2 billion – compared to 4.5 billion in 2021.9

| Jahr | Number of parcels | Parcels per sec. | Parcels per day |

|---|---|---|---|

| 2022 | 4,2 bn | 133 | 11,5 m |

| 2021 | 4,5 bn | 143 | 12 m |

| 2020 | 4,1 bn | 130 | 11 m |

Development of German parcel volumes 2020 – 2022

Outlook 2023

BIEK10 has specified the figures for the first half of 2023. German CEP industry volumes fell by 1.5%, with a 1% decline in parcel volumes and a much higher decline of 6% in express and courier shipments, according to the study. The reasons for the significant decline in shipment volumes in the B2B sector were the stagnating overall economic situation in Germany, which led to a decline in production in key sectors, the inflation-induced reluctance of consumers to spend and the associated loss of purchasing power, as well as a greater propensity to save.

After 2018, the World Bank has once again published the Logistics Performance Index (LPI).11 Previously ranked first, Germany has now dropped two places. Among other things, the index measures the ability of individual countries to provide reliable supply chains in terms of trade and transport-related infrastructure and border controls. The most significant decline for Germany was in the area of infrastructure, such as customs, border controls and punctuality. Nevertheless, Germany is still part of a strong network within the EU.

A reliable and short-term forecast for the CEP industry and CEP logistics is more difficult than usual due to the strong positive and negative factors. Despite the economic challenges, the CEP market has proven to be robust. Within the global trade in goods, CEP service providers close shipping gaps and are indispensable when it comes to speed and reliability.

Sources:

1) https://www.wto.org/english/news_e/news23_e/wtoi_24aug23_e.htm

2) https://www.effigy-consulting.com/global-cep-market-2021/

3) 23-mktc-03596-2023_global_parcel_shipping_index_ebook-web.pdf

4) https://www.effigy-consulting.com/european-cep-market-trends-21-22/

5) https://www.effigy-consulting.com/european-cep-market-outlook-2023-2026/

6) https://www.effigy-consulting.com/global-cep-market-2021/

7) https://www.effigy-consulting.com/2022-european-parcel-market-preliminary-estimate/

8) https://www.iata.org/en/iata-repository/publications/economic-reports/air-cargo-market-analysis—august-2023/

9) 23-mktc-03596-2023_global_parcel_shipping_index_ebook-web.pdf

10) https://www.cep-research.com/news/german-cep-market-is-set-for-smaller-peak-season

11) https://www.logistik-watchblog.de/neuheiten/3932-schwaechen-puenktlichkeit-deutschland-verliert-logistikweltmeister.html?utm_source=newsletter&utm_medium=email&utm_campaign=lwb

12) https://www.verkehrsrundschau.de/nachrichten/transport-logistik/deutschland-nicht-laenger-logistikweltmeister-3365732