Diagonal Cumulation in international Trade in Goods

If goods are transported within a cumulation zone in international trade, primary materials can be treated as the exporting country’s own originating materials under certain conditions. The EU customs process is known as cumulation (accumulation). We would like to take a look at when companies should be concerned with this.

Tariff Preferences and Preferential Zones

The EU has concluded trade agreements with numerous countries or grants unilateral tariff preferences. The product groups to which the tariff preferences apply can vary greatly. However, the negotiated tariff concessions generally only apply to goods that originate from one of the contracting states. What exactly this means depends on whether it is a free preference or a preferential origin.

Free preference

In the case of a free preference, goods must be in free circulation in the country of origin, i.e. all possible customs duties and taxes must have already been paid there. No further customs duties are then incurred on import into the territory of the respective contractual partner.

Preference of Origin

In the case of preferential origin, on the other hand, the application of the preferential rules depends on the origin of the (input) materials and their treatment and processing.

Cumulation Zone and Processing List

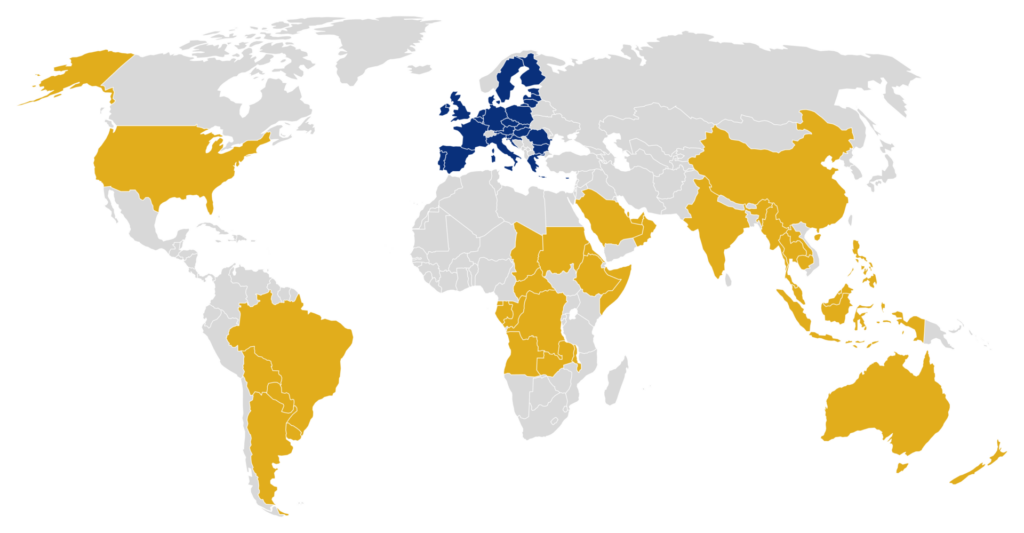

Preferences of origin are particularly complicated when input materials come into play that were produced outside the preferential or cumulation zone, i.e. the territory of all partners bound by a contract with each other. Every free trade or preferential agreement contains a so-called processing list, which specifies exactly which goods the preferences apply to and how which input materials may be processed without affecting the customs benefits (so-called preferential origin).

However, the use of other input materials or unauthorised processing steps can mean that the goods no longer fall under the scope of the relevant trade agreement and the full customs duties must be paid. Company managers who handle a lot of international goods shipments should therefore know exactly when cumulation rules can be applied and what needs to be taken into account.

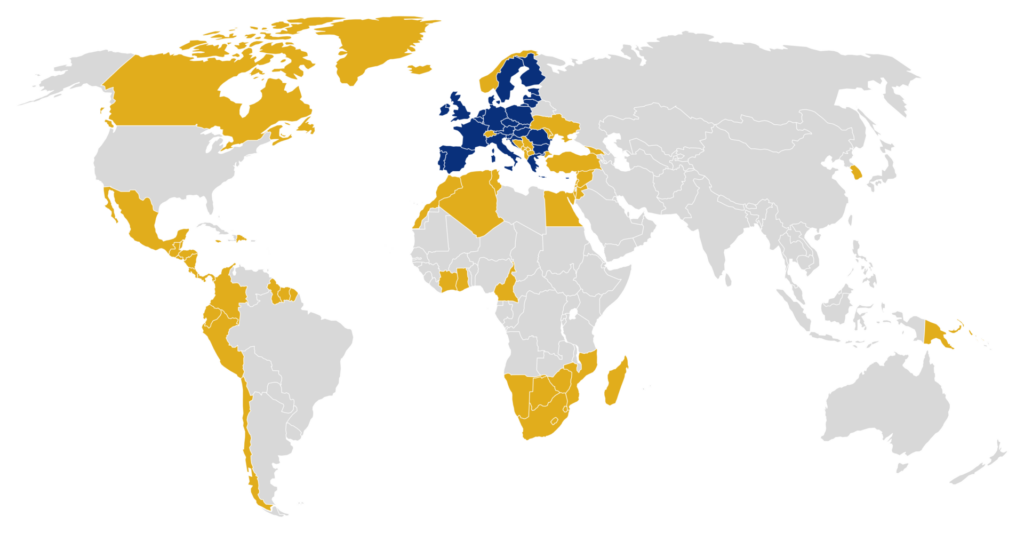

EU Trade Agreements

Cumulation simply explained

Cumulation in the sense of customs law means that originating status is accumulated, i.e. that primary materials take on the originating status of the end product. In other words, the processing is deemed to have taken place within the country of origin of the end product. In principle, a distinction is made between restricted and full cumulation and between bilateral and diagonal cumulation.

Restricted Cumulation

In the case of restricted cumulation, only materials with proven origin of the proven origin of the respective partner states may be used, so that the end product is treated as a good with preferential origin. The preferential origin must then be declared by means of a preference certificate or a simple declaration of origin on the invoice.

Full Cumulation

By contrast, materials without preferential origin may also be used in the case of complete or full cumulation. However, these materials must nevertheless originate from one of the partner states and have already been processed there. Proof of this is provided by means of cross-border supplier declarations for goods without preferential origin status.

Bilateral Cumulation

With bilateral cumulation, only two countries are involved in the process. Raw materials are exported from country A to country B, where they are further processed and the finished product is then re-imported to country A.

Diagonal Cumulation

Diagonal cumulation involves several contracting parties within a cumulation several contracting parties within a cumulation zone that can exchange primary materials and end products with each other. In this case, the input materials can come from a from a country other than the country in which they are processed and the receiving country.

Example of full diagonal Cumulation

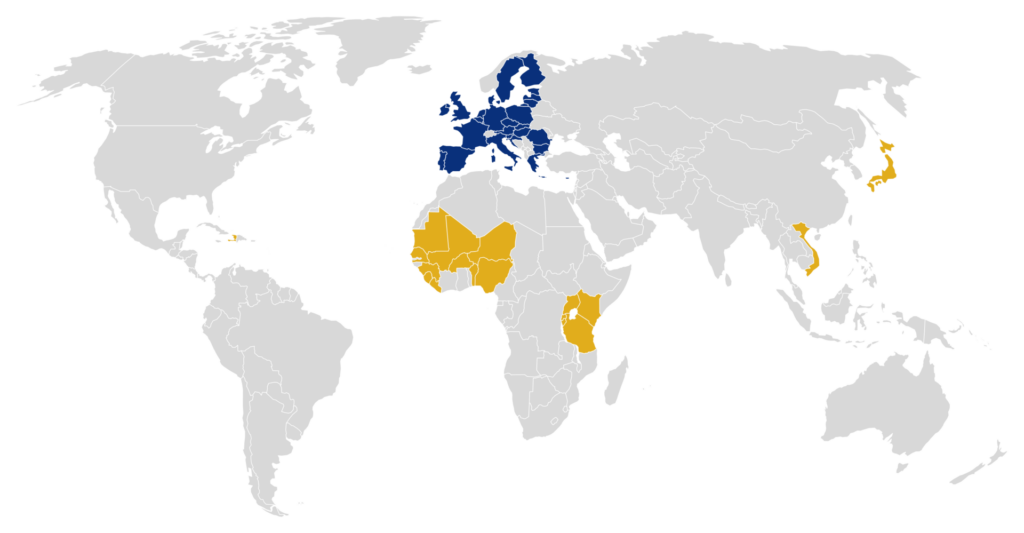

Norway, Iceland and the EU together form the European Economic Area (EEA) free trade zone. In Norway, cotton fibres supplied from the USA are spun into yarns and then exported to the EU. There, the yarns are further processed into cotton fabric and then delivered to Iceland as goods originating in the EEA. However, the production of the fabric within the EU does not constitute a sufficient working or processing activity, as the processing list provides for “manufacture from fibres”.

However, full diagonal cumulation is possible between the EEA partners EU, Norway and Iceland. This means that the processing of the fibres carried out in Norway is counted towards the acquisition of EEA origin when checking origin in the EU. This is possible because the non-originating cotton fibres imported from the USA have already been sufficiently worked or processed in the EEA, i.e. in this case in Norway, for the end product – the fabric – to acquire originating status.

Which Customs Documents are required?

Customs law distinguishes between the origin and provenance of a product. The country of origin is the country from which the goods are imported. However, as already mentioned, mere origin is not sufficient for goods to be cleared through customs in accordance with the agreed preferential origin measures. Rather, the origin is decisive. In the case of cumulated goods, this is also referred to as preferential origin. In order for the EU customs authorities to recognise this preferential origin, suppliers must submit a verifiable declaration of the processing or treatment carried out.

Creating a Supplier’s Declaration correctly

Completing supplier declarations is actually quite straightforward. This is because the wording for a cross-border “supplier’s declaration for goods without preferential origin status” is precisely defined in the preferential agreements. Which wording must be used and when – as these vary depending on the agreements – can be obtained from the competent customs authority both in the country of origin as well as the EU. In principle, however, the goods must be clearly labelled and it must be stated for which possible preferential measures the rules of origin are fulfilled in terms of the subsequent countries of destination.

Instead of the individual country names, their ISO alpha-2 codes may also be used. However, country group designations such as EFTA or MENA are not permitted. The abbreviation EC is also not permitted, as it can lead to confusion with Egypt, whereas EU is accepted.

Supplier declarations can also be issued retrospectively and must then be recognised by the customs authorities. However, suppliers must actively do this, as the customs authorities do not request missing declarations.

What is a long-term Supplier’s Declaration?

A long-term supplier’s declaration is a one-off declaration that explicitly covers future deliveries of the same goods with the same preferential origin characteristics. It is valid for a maximum of two years and can be issued retroactively for up to one year.

It is important to note that the date of delivery of the goods is decisive for the validity of the long-term supplier’s declaration in the event of cumulation. So if a company exports goods in 2022 that or whose input materials with preferential origin status were already purchased in 2021, a declaration with a validity period of 2021 is required, and not with a validity period of 2022.

Consequences of an incorrectly issued Supplier’s Declaration

If customs establishes incorrect information on the certified origin during an inspection, the declaration is invalid and no cumulation is applied. The goods must be subsequently cleared through customs. In addition to the consequences under tax and customs law, there may also be consequences under criminal and civil law if, for example, the importer has to bear higher costs due to the incorrect information provided by the exporter.

What those responsible in Companies should look out for

Those responsible for shipping goods should carefully check which countries the EU has concluded preferential or free trade agreements with and whether the application of cumulation can save costs when importing or exporting – especially when importing from countries in the EEA or the Pan-Euro-Med Agreement.

Also be aware that suppliers are not obliged to submit a customs-relevant supplier’s declaration. It may therefore be advisable to contractually stipulate the obligation to issue this declaration in the purchase contract.

Do you have any questions about import and export shipping or customs? The logistics experts at our Inhouse Customer Service are available to help you personally.